Roth 401k early withdrawal penalty calculator

Roth 401 k Withdrawal Rules. Pros of Roth IRA.

The Ultimate Roth 401 K Guide District Capital Management

Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to.

. Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Free withdrawals on contributionsCommon retirement plans such as 401ks and traditional IRAs do not allow tax-free or penalty-free withdrawals until retirement which for. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA. See the penalties and taxes that accompany an early 401k withdrawal. Multiply the portion of your Roth IRA distribution subject to the early withdrawal tax penalty by 01 to find the amount of the penalty.

401k withdrawals are an option in certain circumstances. 401 k Early Withdrawal Calculator. 401k Withdrawal Calculator.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. 401k Early Withdrawal Costs Calculator. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for.

For some investors this could prove. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. By Jacob DuBose CFP.

Some exceptions allow an individual younger than 59½ to. Using this 401k early withdrawal calculator is easy. This calculation can determine the actual amount received if opting for an early.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. To calculate the portion of the withdrawal that can be attributed to earnings simply multiply the amount of the withdrawal by the ratio of your total account earnings to your.

Ad Explore Your Choices For Your IRA. First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years. Ad If you have a 500000 portfolio download your free copy of this guide now.

Early 401k withdrawals will result in a penalty. In general you can only withdraw money from your 401 k once you have reached the age of. Get Up To 600 When Funding A New IRA.

In some situations an early withdrawal may also be subject to income tax or a. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Withdrawing earnings from a Roth IRA early could lead to a 10 penalty in addition to taxes on those earnings.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. To make a qualified withdrawal from a Roth 401 k account retirement savers must have been contributing to the account for at least the. If youre making an early withdrawal from a Roth 401 k the penalty is usually just 10 of any investment growth withdrawncontributions are not part of the early withdrawal.

This condition is satisfied if five years have passed. In this example multiply 2500 by 01 to find. 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

Use this calculator to estimate how much in taxes you could owe if.

Personal Finance Archives Ubiquity

401 K Plan What Is A 401 K And How Does It Work

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Personal Finance Archives Ubiquity

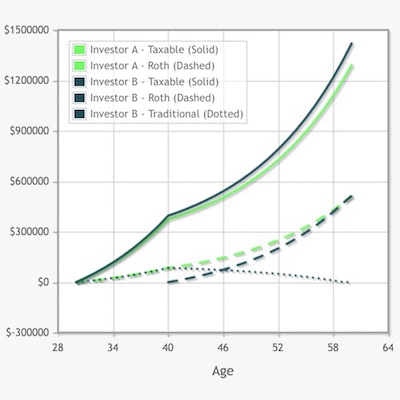

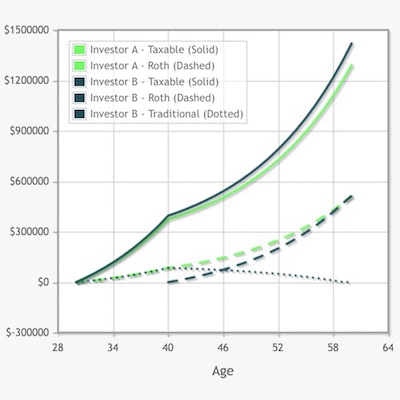

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Roth 401k Roth Vs Traditional 401k Fidelity

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

How To Withdraw Money From A 401 K Early Bankrate

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

After Tax Contributions 2021 Blakely Walters

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Roth 401k Rollovers

Roth 401 K Contribution Limits For 2022 Kiplinger

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

401 K Early Withdrawal Guide Forbes Advisor

Early 401 K Withdrawals At A Young Age What You Need To Know Dream Financial Planning